Sunstone Opportunity Fund Limited Partnership

Investment Properties |

| |

| First closing: |

March 4, 2004 |

| Second closing: |

April 1, 2004 |

| Total units: |

1,234 |

| Per unit: |

$12,500 |

| Debenture interest rate: |

9% |

| Equity raised: |

$15,425,000 |

| Total portfolio acquired: |

$44,190,000 |

| Number of properties: |

3 (3 divested) |

| Gross sale proceeds: |

$58,050,000 |

|

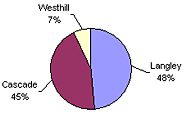

Properities by

Purchase Price

|

| |

|

Langley Crossing Shopping Centre

Langley, BC |

| Purchase price: |

$21,300,000 |

| Purchase date: |

April 2004 |

| Property type: |

Retail & office |

| Net rentable area: |

128,719 sq. ft. |

| Date sold: |

September 2005 |

| Sale price: |

$29,000,000 |

|

|

| |

|

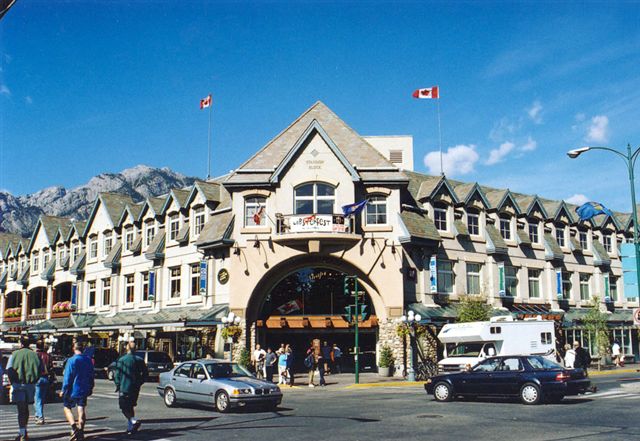

Cascade Plaza – 50% interest

Banff, AB |

| Purchase price: |

$19,850,000 |

| Purchase date: |

August 2004 |

| Property type: |

Shopping centre |

| Area: |

82,884 sq. ft. |

| Date sold: |

October 2005 |

| Sale price: |

$25,500,000 |

|

|

| |

|

Westhill Centre

Nanaimo, BC |

| Purchase date: |

September 2004 |

| Purchase price: |

$3,040,000 |

| Property type: |

Retail & office |

| Area: |

32,294 sq. ft. |

| Date sold: |

October 2005 |

| Sale price: |

$3,550,000 |

|

|

| Each unit was acquired for $12,500 and all of the properties were sold within 18 months of initial investment. |

| |

|

|

Summary of cash distributions paid to Limited Partners |

Total |

Per $2,500 unit |

| In 2004 |

$ 104,119.00 |

$ 84.38 |

| In 2005 |

$ 9,135,456.00 |

$ 7,403.12 |

| In April 2006 |

$ 641,680.00 |

$ 520.00 |

| In June 2006 |

$ 237,545.00 |

$ 192.50 |

| Total cash received |

$ 10,118,800.00 |

$ 8,200.00 |

| |

|

|

| Summary of distributions paid on the Series A Debentures |

Total |

Per $10,000 debenture |

| In 2004 |

$ 918,145.36 |

$ 744.04 |

| In 2005 |

$ 854,248.84 |

$ 692.26 |

| Debenture redemption Oct. 2005* |

$ 12,340,000.00 |

$ 10,000.00 |

| Total interest received |

$ 14,112,394.20 |

$ 11,436.30 |

| * Please note that this amount represents the full face value of the Series A Debentures. |

| |

|

|

| Total cash received from March 2004 to June 2006 |

$ 24,231,194.20

|

$ 19,636.30

|

| |

|

|

| In summary, from date of investment to the date the last property was sold, investors' total net return was 157.09%, Annualized Return (IRR) 30.06%. |

|

|